main street small business tax credit sole proprietor

Best Business Credit Cards for Sole Proprietorships From Our Partners Our pick for Travel rewards bonus. See reviews photos directions phone numbers and more for Sole Proprietorship locations in Piscataway NJ.

2021 Main Street Small Business Tax Credit In California Heather

Use Fill to complete blank online CALIFORNIA pdf forms for free.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

. A qualified small business employer is a taxpayer who meets the following requirements. Choosing a business name for your website or blog involves understanding something about federal trademark law -- please see the Trademark for Business Naming. 1223 Fairfield Street Westfield New Jersey and his SSN is 158-68-7799.

Allocation of Individual Income Tax to. Application for Automatic Extension of Time to File. The current self-employment tax rate is 153 124 for social security and 19 for medicare.

Once completed you can sign your fillable form or send for signing. Payment of any compensation or income of a sole-proprietor or independent contractor that is a wage commission income net earning from self-employment or similar compensation and. Substitute for Form W2 and 1099R.

All forms are printable and downloadable. An eligible small business is defined as one of the following. Works with Credit Cards Processing Company Harbortouch Office to offer you a.

Tax on Lump Sum Distributions. A qualified small business tax credit employer is the one who files an original tax return to get the Main Street Small Business tax credit instead of an amended one. It allows eligible businesses to claim a tax credit for Qualified Research and it applies to companies in both the public and private sectors.

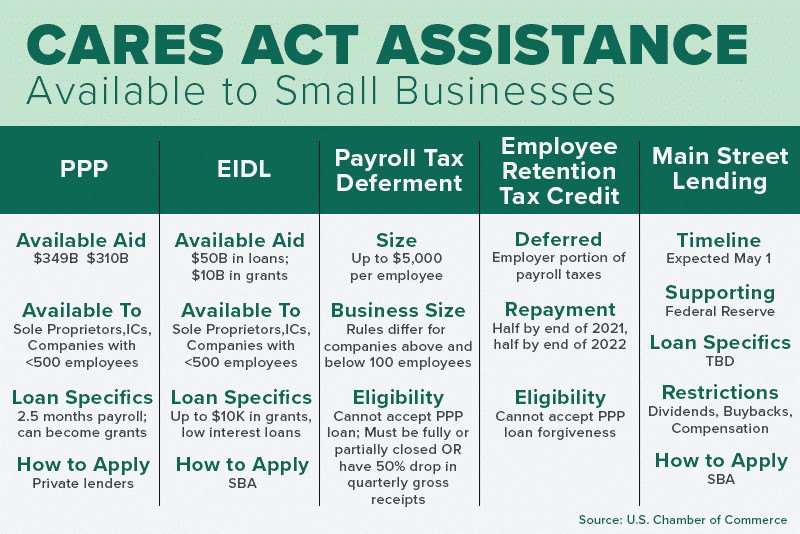

Expenses paid by his business are Advertising 500 Supplies 2900 Taxes and licenses 500 Travel other. Originally the RD credit was. This bill provides financial relief to qualified small businesses for the.

Power of Attorney and Declaration of Representative. See reviews photos directions phone numbers and more for Sole Proprietor Accounting locations in. Had 100 or fewer employees on December 31 2019.

Main Street Business Loans MSBL and Merchant Cash Advance MCA Alternative Working Capital. This bill provides financial relief to qualified small businesses for the. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit.

Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II. Application for Automatic Extension of Time to File. Had a 50 decrease in income tax gross.

Fortunately sole proprietors can deduct half of their self-employment tax.

Sole Proprietorship Vs Llc Main Differences Bench Accounting

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

10 Tax Benefits Of C Corporations Guidant

Covid 19 Small Business Resources Sbdcnet Official U S Sba Resource

Tax Reform For Small Businesses Nfib

What Is The Main Street Small Business Tax Credit Tax Hive

Main Street Tax Credit Ii More Than 100 Million In The 2021 Main Street Small Business Tax Credit Ii Are Available To Help Qualified Small Business Owners Credits Are First

Small Business Tax Prep 101 What To Bring To Your Tax Appointment Legalzoom

Small Business Tax Credits The Complete Guide Nerdwallet

2021 Federal Tax Deadlines For Your Small Business

Main Street Small Business Tax Credit Available For Cal Businesses

2021 Main Street Small Business Tax Credit Ii

Tax Credits And Incentives To Benefit Growing Businesses Part 1 Marcum Llp Accountants And Advisors

What Is The Main Street Small Business Tax Credit Tax Hive

Sole Proprietorship Vs Llc A Guide To Tax Benefits Liabilities

Small Business Tax Credits The Complete Guide Nerdwallet

Main Street Small Business Tax Credit Available For Cal Businesses